Updated Filing Programme For the Year 2020

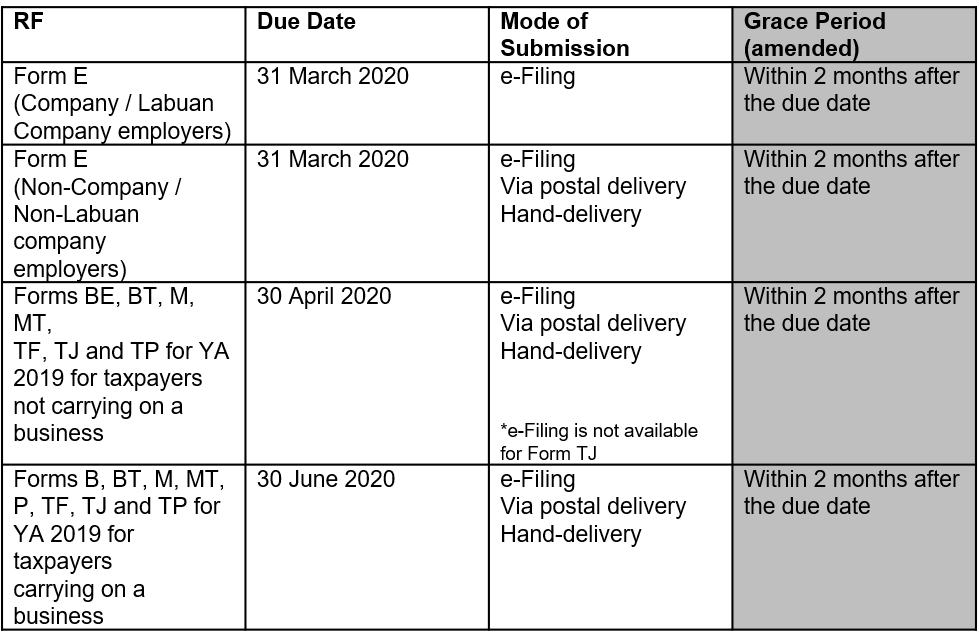

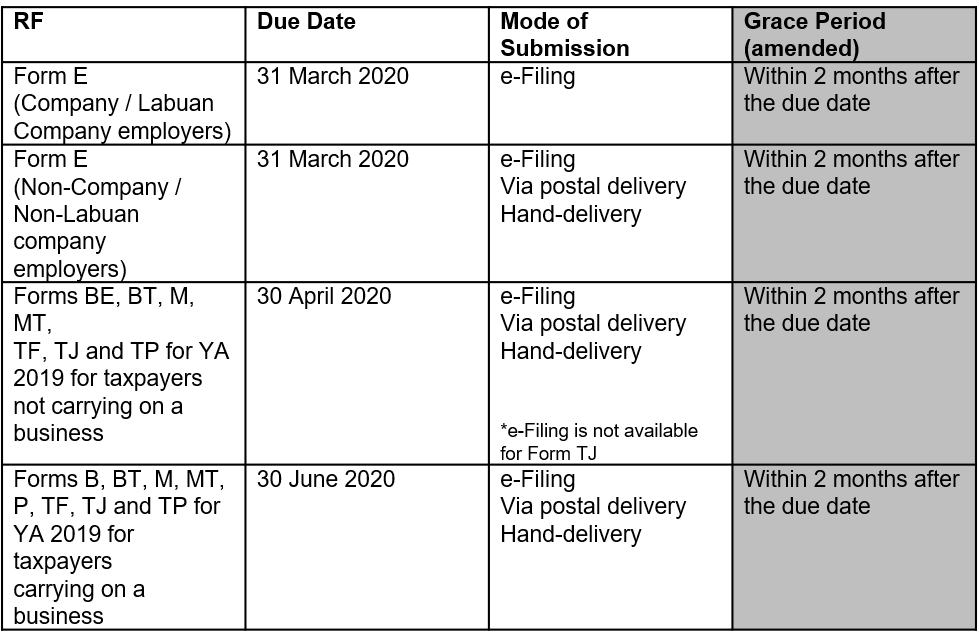

Kuala Lumpur, 18th March 2020 – With the implementation of the Movement Control Order announced by the Government, the IRB has amended the 2020 income tax return filing programme (2020 filing programme) titled “Return Form (RF) Filing Programme For The Year 2020 (Amendment 1/2020)” [click here]. The following is a summary of the key changes on the grace period for submission of return forms and payment of balance of taxes.

1. Return Forms for Employers, Individuals, Partnerships, Associations, Deceased Persons’ Estate and Hindu Joint Families

2. The grace period for submission of return forms and payment of balance of tax for Companies, Co-operative Society, Limited Liability Partnership and Trust Bodies as well as Petroleum sector remains unchanged (i.e. 1 month grace period from the due date of the submission ). However, 2 months grace period from the due date of the submission is granted to those taxpayers with accounting period ending 31 July 2019, 31 August 2019, 30 September 2019, 31 October 2019 and 30 November 2019.

For any enquiries or assistance, please contact any of the following in this office:

Mr Anand Chelliah Managing Partner

Tax Services Asia Pacific Tax Leader

DL: +6 (0)3 2297 1093

anand.chelliah@bakertilly.my

Tax Services Asia Pacific Tax Leader

DL: +6 (0)3 2297 1093

anand.chelliah@bakertilly.my

Mr Marcus Tan

Executive Director (Corporate Tax & Tax Incentive), Tax Services

DL: +6 (0)3 2297 1521

marcus.tan@bakertilly.my

Executive Director (Corporate Tax & Tax Incentive), Tax Services

DL: +6 (0)3 2297 1521

marcus.tan@bakertilly.my

Mr Yohan Francis

Executive Director (Transfer Pricing), Tax Services

DL: +6 (0)3 2297 1096

yohan.xavier@bakertilly.my

Executive Director (Transfer Pricing), Tax Services

DL: +6 (0)3 2297 1096

yohan.xavier@bakertilly.my

Mr Murugan Anbanantham

Director (Technical), Tax Services

DL: +6 (0)3 2297 1004

murugan.anbanantham@bakertilly.my

Director (Technical), Tax Services

DL: +6 (0)3 2297 1004

murugan.anbanantham@bakertilly.my

Ms Tay Siew Chu

Associate Director (Corporate Tax & Personal Tax), Tax Services

DL: +6 (0)3 2297 1139

siewchu.tay@bakertilly.my

Associate Director (Corporate Tax & Personal Tax), Tax Services

DL: +6 (0)3 2297 1139

siewchu.tay@bakertilly.my

Ms Sandra Saw

Associate Director (Corporate Tax & Sales Tax & Service Tax), Tax Services

DL: +6 (0)3 2297 1146

sandra.saw@bakertilly.my

Associate Director (Corporate Tax & Sales Tax & Service Tax), Tax Services

DL: +6 (0)3 2297 1146

sandra.saw@bakertilly.my

- End-